Insurance Services

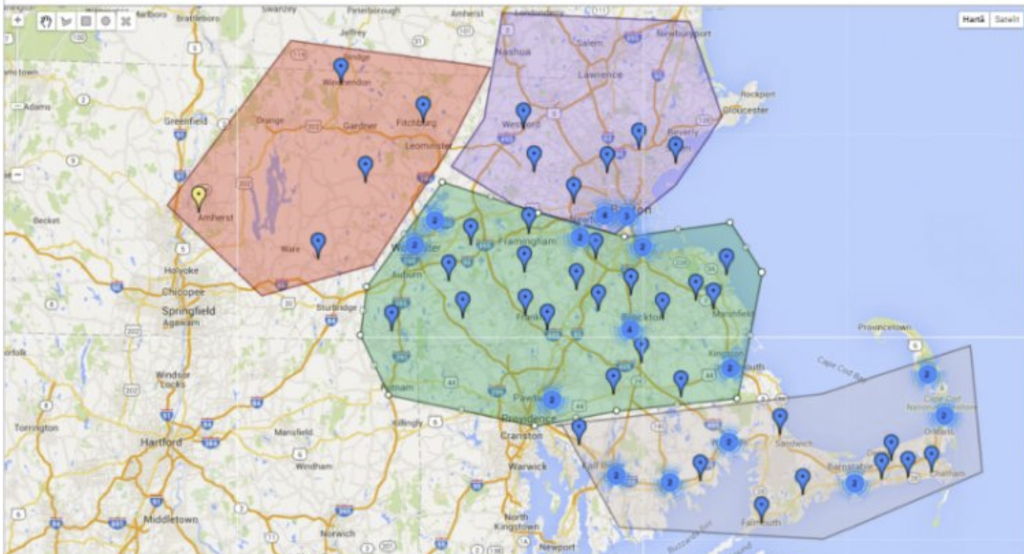

Optimize Territory

We can build geospatial analytics that can be used to establish precise benchmarks that will guide sales, enhance territory optimization, and increase customer retention.

GIS for Insurance Agencies

At Geoux Teche, we have the expertise and technical resources to convert and automate agency management data into a geospatial format that allows you to quickly locate and evaluate risk(s) when preparing quotes for new business or renewal.

Building Relationships

Prior to submitting a quote for insurance, we can provide specific insurance analysis that can improve your agency’s approval rates with carriers and build trustworthy relationships with underwriters.

Underwriting

Here at Geaoux Teche, our team of experts can transpose hidden data into visual aids to locate and mitigate hidden risks and exposures. Our team of experts can assist with streamlining and integrating GIS into your internal underwriting processes to maximize profitable opportunities, manage regulatory requirements, and promote stability.

Merge GIS insights with Underwriting:

- Homeowners/Dwelling Fire

- Business Owners Policy

- Commercial Fire and Allied

- Umbrella

- Farm & Agriculture

- Flood and Excess Flood

Claims

We understand that each claim is unique and is handled based up its own specific conditions. At Geoux Teche, we can assist you with building a dynamic framework for business resilience to analyze and discover unknown problems, model situations, automate Standard Operating Procedures (SOP), and implement the best solutions to minimize risk.

Our team of insurance specialist are familiar with the insurance process (pre and post landfall) of a catastrophic event. We fully understand the importance of using spatial analytics technology to help proactively mitigate risks before a threat actually happens.

We can also assist your claims team with automating your Standard Operating Procedures (SOP) to gain geospatial insight around these catastrophic (CAT) events and can keep decision-makers informed.